Behavioral Economics: The Revolutionary Discipline

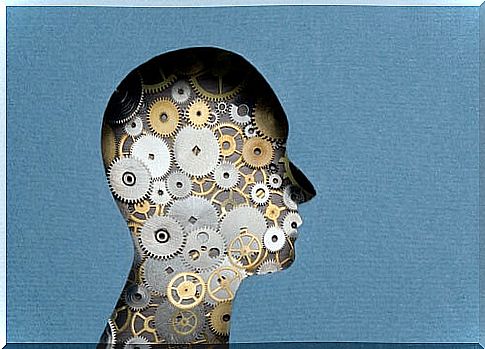

Behavioral economics is the product of the encounter between economics and psychology. He postulates that indirect suggestion can influence decision-making just as effectively as direct and rational instruction.

The principle of rationality that guides the economy is the result of capitalist relations of production and exchange. Before capitalist relations emerged, economic activity pursued goals imposed by tradition. For example, cultivating the land for food, weaving for clothing, etc. He resorted to means inherited from previous generations, without rationally analyzing one or the other.

Richard Thaler argues that the fundamentals of conventional economics , which believes only in efficient markets inhabited by rational actors, are false. Man is not the calculating machine that populates the economics books. It is rather this strange creature subject to many prejudices and biases. One of the reference books in which this idea is expounded is Bad Behavior: Discoveries of Behavioral Economics.

Behavioral economics: the push concept

In 2017, Richard H. Thaler, a pioneer in behavioral economics, received the Nobel Prize in Economics for his study of nudging. Nudges are simple devices to guide our behavior.

This is one of the emblematic examples of Nudge: The gentle method to inspire the right decision . Richard H. Thaler and Cass R. Sunstein study “nudges”, simple and intelligent devices that involve more than our reason.

A detail, as in the case of the fly, can encourage us to act in a certain way. These nudges are based on a number of cognitive biases.

Behavioral economics: cognitive biases

In the book there are more than 30 prejudices when making decisions. We leave you some of the most important:

- Forer effect : it is the observation that individuals give approval to descriptions of their personality that have supposedly been made specifically for them. These are actually general and vague enough to apply to a wide spectrum of people.

- Framing bias: the decision of individuals is strongly related to the way in which the various options are presented. For example, the size of the plate influences the amount consumed.

- Anchoring bias : people rarely make decisions without a baseline situation. For example, a past decision or a decision made by someone else.

- Loss aversion bias – Individuals hate earning more money if they can’t spend it. For example: an individual would prefer to receive 1800 euros of net salary instead of 2000 euros gross, of which 200 would go to taxes.

- Confirmation bias : consists of the tendency to interpret information in a way that confirms preconceptions. The effect is strongest in posts with emotional content and firmly rooted beliefs.

- Hindsight prejudice : once you know what has happened, you tend to modify the memory of the opinion prior to the events occurring in favor of the final result.

- Blind spot bias: it is the tendency not to recognize our own biases. The subject is seen as less influenced than the average person.

- Maximum extreme overestimation bias : People rate their past experiences based on their highlights or their last impression. For example, the probability of an accident is overestimated if the person has had one recently.

- Short-term bias or “hyperbolic discount” – In many cases, people value future tips less than immediate gratification. For example, the pleasure of nicotine compared to the risk of a cardiovascular event. Unlike homo oeconomicus, it is not a mere preference for the present, but rather a “hyperbolic” preference (in the almost mathematical sense of the term) for the present.

Behavioral economics: the concept of “pushes”

The so-called “nudges” aim to exploit the biases of individual rationality to guide individual decisions in the direction of the general interest. Here’s what’s explained in the 2008 bestseller: Nudge: The Kind Way to Inspire the Right Decision .

By defining themselves as paternal libertarians, they intend to act on the architecture of choice and the correct behavior. For example, by making salad more directly accessible than hamburger, one can expect people to be more tempted to have a salad.

This would make people eat healthier and there are fewer subjects prone to obesity and therefore have fewer diseases that require public money, etc.

The jostling finally won over readers and professionals. Several states and international organizations have opened “Nudge Units”, similar to research centers and laboratories.

An example of behavioral economics in organ donation research

With the implicit consent policy, all citizens are organ donors. Although they have the opportunity to express their desire not to be. According to traditional economic logic, having to give explicit consent would have the same results as implicit acknowledgment.

However, many findings from behavioral economics show that this is not the case. An important experiment, carried out by Eric Johnson and Dan Goldstein (2003), showed us to what extent the default option matters in this matter.

In a survey , respondents were asked in different ways if they would be willing to be a donor. In the explicit consent situation, participants were told that they had just moved to a new state where the default rule was not to be a donor. They were given the option to confirm or modify that status. In the case of implicit consent, the only variation was that the default rule was to be a donor.

In the third situation, neutral, no default rule was mentioned, they just had to choose. The results demonstrated the importance of the default rule.

When participants had to actively decide to be donors, only 42 percent did so. But, in the opposite situation, the decision amounted to 82 percent. And in the neutral situation, the decision to be a donor was 79 percent.

Criticisms of behavioral economics

Considering that people are faced with a disorganized environment, the economics of behavior and jostling does not take into account the importance of social organizations and institutions. The state, economic organizations, associations, local authorities play an important role in structuring society and in determining these individual “choices”.

If the economy behavior and shoving seem revolutionary, it is partly because they hide the complexity of the problems they seek to solve. If they can show great effectiveness in some contexts, it is because they depend on social devices, standards and institutions that support this complexity. As is often the case in science and politics, behavioral economics is a dwarf perched on the shoulders of giants.

Behavioral economics cares little for other social science theories of decision making, and its efficacy has yet to be proven. The famous example of the fly has finally been exaggerated and perhaps the fame of the theory fits more with the illusions of the masses than with the certainty of science. Over time we will see if the investigations end up supporting it.